Inclusive Creative

Economy Strategy

Investment Committee

Upstart Co-Lab’s Inclusive Creative Economy Strategy is the first impact investment strategy for the U.S. creative economy. Upstart’s approach will prioritize BIPOC and women entrepreneurs leading companies in creative industries, and deliver people-focused impact: quality jobs, vibrant communities, and sustainable creative lives.

Photo credit:

Helga Sigvaldadotti

Laura Callanan is the founding partner of Upstart Co-Lab, disrupting how creativity is funded by connecting impact investing to the creative economy.

Laura was senior deputy chairman of the National Endowment for the Arts, leading all grant-making programs, operations, and research before launching Upstart Co-Lab in 2015.

As a consultant with McKinsey & Company’s Social Sector Office, Laura led work on social innovation, sustainable capitalism, and social impact assessment. She previously served as senior adviser at the United Nations Development Programme; executive director of the Prospect Hill Foundation; and associate director at the Rockefeller Foundation where, in addition to her responsibilities managing the endowment, she co-led the Foundation’s first impact investing efforts which included two investments in the creative economy: Smithsonian Folkways Records and netomat.

Laura is a board member and immediate past chair for GlobalGiving Foundation, a board member of Upriver Studios, and a member of the British Council Policy and Evidence Centre for the Creative Industries – International Council. She has been a visiting fellow at the Federal Reserve Bank of San Francisco, a scholar-in-residence at UC-Berkeley/Haas School of Business, a visiting scholar to the American Academy in Rome, the recipient of a Rockefeller Foundation Bellagio Fellowship, and an adjunct professor at the New York University’s Stern School of Business. Laura is a past advisor to Shift Capital, a past member of the board of Signature Theatre and the Corporation of Yaddo, and a founding investment committee member and audit committee member for the American Academy of Arts and Letters.

An expert on impact investing, philanthropy and the creative economy, Laura has been published and quoted in The New York Times, Financial Times, Fast Company, Monocle, Forbes, Barron’s, Stanford Social Innovation Review, Harvard Business Review, The Chronicle of Philanthropy, The Art Newspaper and elsewhere. She is a frequent speaker at social sector conferences including the Global Steering Group on Impact Investing, the Skoll World Forum, SOCAP, the Smithsonian Institution Power of Giving, Mission Investors Exchange, Independent Sector, Grantmakers in the Arts, Americans in the Arts, AtlanticLive and many others.

After graduating from Columbia University’s School of International and Public Affairs with a Master of Public Administration degree, Laura worked in public finance investment banking serving universities and other large endowed nonprofit organizations on behalf of JP Morgan and Lehman Brothers, and as associate treasurer for the Wallace Foundation. Laura’s undergraduate degree in theater is from Barnard College of Columbia University.

Laura is the literary executrix for the estate of playwright and novelist Romulus Linney.

Patricia Farrar-Rivas is the co-founder, non-practicing partner and previous CEO of Veris Wealth Partners LLC, a national Impact Investing Wealth Management Firm. She retired in March of 2022. Before founding Veris, she launched the Investment Advisory Subsidiary for Frank, Rimerman and CO, LLP, a regional Silicon Valley Accounting firm. She has 30+ years of experience providing wealth management and consulting services to high-net worth individuals and non-profit organizations and foundations. Since 1992 she has supported the growth of the Mission-related and Impact Investing industry. She co-led the Mission-related Investing introductory day for Confluence Philanthropy, serves on the review committee for Transformative 25 2022, and is an advisor for the Just Economy Institute.

Patricia is a Councilwoman for the City Council of Sonoma, California. She is the Board President for 18 Reasons, a San Francisco Bay Are non-profit building community through home cooking and addressing food insecurity and is a Board Member of the Sonoma Ecology Center. She has a long history of environmental and community focused board service, serving on the boards of As you Sow, Light Hawk, Academy of Friends and US SIF, and was a member of the SASB (Sustainable Accounting Standards Board) Standards Council.

Before her career in Impact Investing, Patricia taught dance and produced dance shows with her company of young dancers, the Mirror Stars.

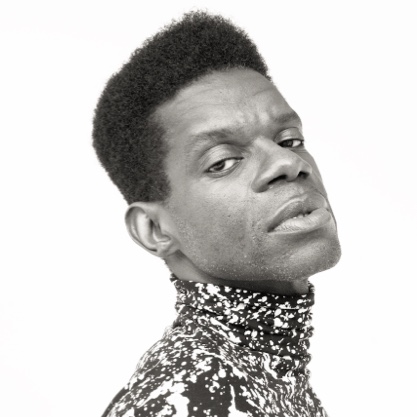

In 2015, Haitian-American designer Victor Glemaud launched his collection of joyous and colorful statement knitwear—marrying comfort and style, while designing for all people, genders, races, sizes and personalities.

Raised in Queens, New York, Victor began his career as design assistant to Patrick Robinson while studying at the Fashion Institute of Technology in New York City. After working as a publicist for Versace and Marc Jacobs, he returned to design in 2005, becoming Studio Director at Paco Rabanne, followed by Style Director at Tommy Hilfiger, and over the years has consulted with several brands, including H&M for the Met Gala.

In 2017, Glemaud was amongst the finalists in the CFDA/Vogue Fashion Fund and honored for his achievements at an event in Washington DC, hosted by the Ambassador of Haiti to the United States.

Some of Glemaud’s most recent collaborations include designing costumes for “La Follia Variations” for the American Ballet Theatre which premiered in early 2021, creating custom bands for Fitbit in 2020 and 2021 as well as successfully launching Fall Designer Collection with Target in September 2021.

In April 2022, he collaborated with Tura on an eyewear collection, Glemaud x Tura, that won him the breakthrough award at the Accessories Council’s 26th Annual ACE Awards. That same year, Glemaud released Cul-De-Sac by Victor Glemaud in collaboration with the American design house Schumacher, his first home collection featuring an imaginative portfolio of fabrics, wallcoverings, and trims.

Mentoring and creating opportunities have always been a part of Glemaud’s philosophy and brand DNA. In 2020, he founded and launched IN THE BLK, a non-profit collective of influential global Black fashion creatives working with industry leaders to promote equitable business growth for emerging Black-owned fashion brands.

Victor Glemaud is currently sold at FARFETCH, Intermix, Revolve, Saks Fifth Avenue, Shopbop, and glemaud.com.

Glemaud currently resides in New York City.

Jack Meyercord is the Founder of Conscious Endeavors LP, a wealth advisory firm focused on impact investing, which he began in 2019. In addition, Jack actively manages a portfolio of investments into companies focused on sustainable and impact themes. Previously, from 2016 – 2019, Jack worked for Bienville Capital as a Portfolio Manager and the Head of Impact Investing. In this role, he helped families and endowments to align their investment strategy with their personal values and mission. From 2013 – 2016, he worked as the Managing Partner of Straight Wharf Capital Management LLC. During this time, Jack has advised a family office on creating a multi-asset class portfolio focused on impact investments. Prior to this, from August 2009 until April 2013, he was the founder and Chief Investment officer of Straight Wharf Asia Master Fund, a long /short equity fund focused on Asian markets, which was seeded by Tiger Management. From January 2000 until August 2009, Jack focused on investing in public equities in the Asian real estate, telecommunications and consumer sectors at several different hedge funds, including Kelusa Capital (2007-2009), Avenue Capital (2005-2007) and Banyan Fund Management (2000-2005).

Jack is a CFA charter holder, received his M.B.A. from Columbia Business School, with honors, in 2000 and graduated with a B.A. in Political Science from Duke University in 1995. Born and raised in New Jersey, he now resides in Bronxville, NY.

Clara Miller writes and speaks about social sector finance, impact investing, and accounting in the nonprofit and for-profit arenas. She advises projects and individuals working for progress on the same. She is President Emerita of the Heron Foundation (2011-2017), and was Founder and President/CEO of Nonprofit Finance Fund (1984-2011).

Miller was named seven times to the Nonprofit Times “Power and Influence Top 50,” (2006-2017), to Inside Philanthropy’s “50 Most Powerful Women in U.S. Philanthropy for 2016 and 2017 and as Social Innovator of the Year by the University of New Hampshire in 2017. In 2015 she was named “Investor of the Year, Small Foundations,” by Institutional Investor Magazine, received the Prince’s Prize (Monaco) for Innovative Philanthropy and the Shining Star Award from Performance Space 122 in New York City. She was awarded a Bellagio Residency by the Rockefeller Foundation in 2010.

Miller is an advisory board member for the U.S. Impact Investing Alliance, the Song Cave and the Sustainability Advisory Board at the University of New Hampshire. She is a senior adviser to the Open Road Alliance. Miller is also on the Investment Committee for the Upstart Co-Lab Inclusive Creative Economy Strategy. Miller served as a board member of the Sustainability Accounting Standards Board (2012-2019) and was a Bridgespan Fellow 2018-2020.

Miller was a member of the U.S. Treasury’s first Community Development Advisory Board for the then-newly-created Community Development Financial Institutions Fund in 1996 and later became Chair. She chaired Opportunity Finance Network’s board for six of her nine years as a member and served on the Community Advisory Committee of the Federal Reserve Bank of New York for eight years.

Ms. Miller has been published in Alliance, Financial Times, Medium, The Atlantic Blog, Stanford Social Innovation Review, Nonprofit Quarterly and Chronicle of Philanthropy. She has spoken recently at the Federal Reserve Bank of New York, Edinburgh International Culture Summit, Yale School of Management, Dartmouth’s Tuck School, Stanford Graduate School of Business, Columbia Business School, Aspen Ideas Festival, Sciences Po, Oxford Said Business School, Bloomberg L.P., and SoCap.

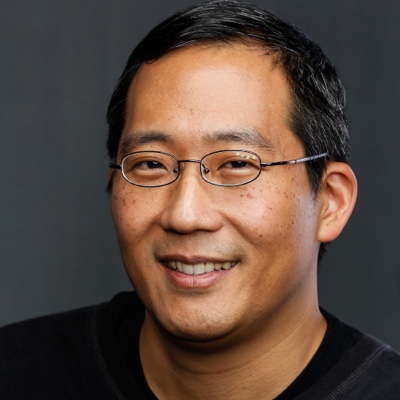

Chris Yeh is the co-founder of the Blitzscaling Academy, which teaches individuals and organizations how to plan for and execute on hypergrowth, and of Blitzscaling Ventures, which invests in the world’s fastest-growing startups. Chris has founded, advised, or invested in over 100 high-tech startups since 1995, including companies like Ustream (investor, advisor, CEO) and UserTesting.com (NYSE: USER; advisor). He is the co-author, along with Reid Hoffman, of Blitzscaling: The Lighting-fast Path to Building Massively Valuable Companies, and the co-author, along with Reid Hoffman and Ben Casnocha, of the New York Times bestseller, The Alliance: Managing Talent in the Networked Age. Chris earned two degrees from Stanford University, with distinction in both, and an MBA from Harvard Business School, where he was named a Baker Scholar.